A new report finds that 65 percent of all diabetes app downloads are handled by only 14 app publishers, the majority of which are small tech companies.

The report by Research2Guidance, "Diabetes App Market 2014," finds that the market is "still very fragile," with only 1.2 percent of the world's "addressable market" (diabetics using a smartphone or tablet) actually using mobile diabetes apps. But that number is expected to grow to 7.8 percent by 2018, according to the Berlin-based mobile app research company.

Company officials say the rankings can easily change, and likely will as more and better app developers move into the space. But they don't predict any major upheavals.

[See also: Diabetes apps assuming mHealth bellwether role.]

"The overall quality, total download and user numbers are not that high today so that new innovators complying with the best practice standards for diabetes app publishing and a good marketing strategy would not be able to turn the market upside down," R2G officials explained in a blog.

That's good news for a market in near epidemic-mode that measured roughly 382 million globally in 2013 and is expected to double by 2030.

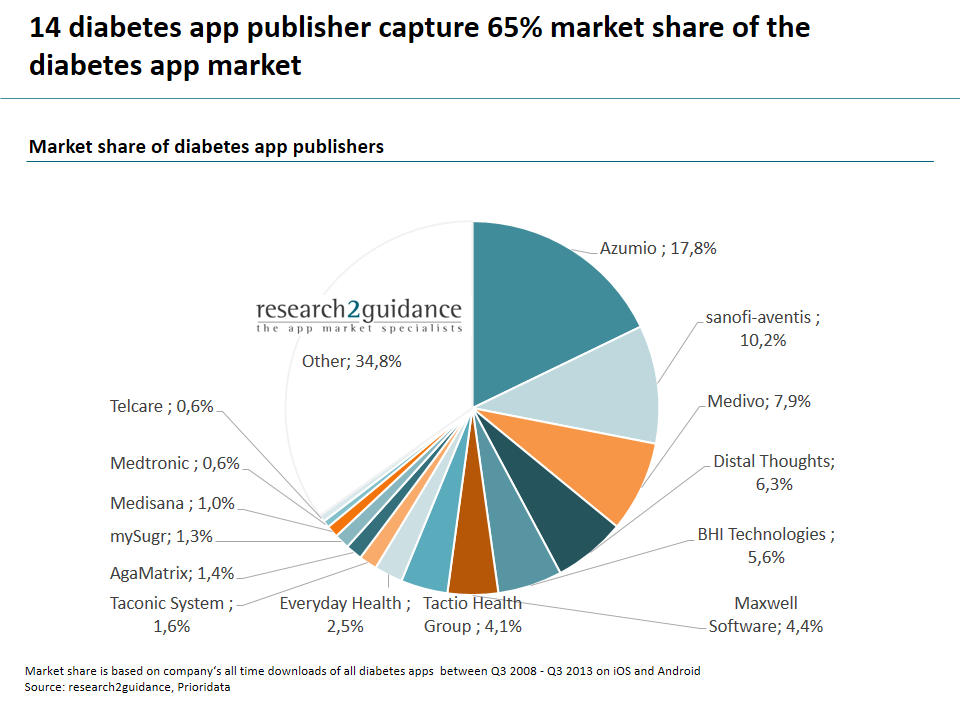

According to R2G, Azumio, a San Francisco-based company that markets the Glucose Buddy and Blood Sugar Trackers apps, controls the top spot in the market with 17.8 percent of the downloads. Sanofi-aventis, a pharma giant that produces the GoMeals and iBGStar apps, comes in second with 10.2 percent of the market share.

Behind those two are three small companies, each holding a market share of just above 5 percent: Medivo, launched in 2010 and based in New York City (7.9 percent); the Netherlands-based Distal Thoughts (6.3 percent); and a company called BHI Technologies (5.6 percent).

After that are Maxwell Software (4.4 percent), Tactio Health (4.1 percent), Everyday Health (2.5 percent), Taconic Systems (1.6 percent), AgaMetrix (1.4 percent), mySugr (1.3 percent), Medisana (1 percent), and Medtronic and Telcare (.6 percent).

There are more than 1,100 iOS and Android specific diabetes apps available on the Apple App Store and Google Play, according to company officials. A previous survey, however, had pointed out that many apps aren't being used – or are being used a few times and then dropped – because they're unreliable or ineffective.

R2G officials see five factors driving future diabetes app penetration:

- More people with diabetes will be using mobile devices, making them reachable via a mobile app

- Diabetes apps will develop from a stand-alone product to a bundle product, combining with plug-in devices like glucometers and wearable sensors to deliver a more complete remote monitoring solution.

- As more diabetes apps hit the market, the quality level will increase and the market will adopt best practices from other app models.

- Traditional payers will reimburse for effective diabetes apps, prompting app makers to prove their value.

- The next five years will see the diabetes app market rise "to a new level," with a "major market breakthrough" possible.

"Mobile health solutions are expected to be able to help delivering solutions to help assisting diabetes patients, especially by empowering them to better manage their condition and thus reduce the healthcare costs," R2G officials said in the blog. "Mobile diabetes apps are able to make diabetes patients’ lives easier by supporting behavior changes, facilitating communication and help tracking all relevant diabetes parameters. Diabetes is the therapeutic area with the highest business potential for mHealth apps – named by 76 percent of mHealth app publishers in research2guidance’s yearly mobile health surveys."

Related articles:

3 tips to make the most of BYOD