MedAdvisor, a listed provider of medication management solutions, has sold its business in Australia and New Zealand and associated intellectual property to the Australian unit of Canadian company Jonas Software for A$35 million ($22.8 million).

Jonas Software is part of Toronto-listed Constellation Software, a known software business acquirer.

On 7 July, MedAdvisor completed the sale of its ANZ business, with a performance-based earn-out potentially worth A$7.35 million ($4.8 million) after three years.

"With the completion of this transaction, the MedAdvisor business in Australia now becomes a private software company under the Jonas umbrella. This transition creates an opportunity for the ANZ business to continue its strong legacy of delivering innovative digital solutions to community pharmacies," explained CEO and managing director Rick Ratliff.

In a corporate disclosure, the company noted that it will remain listed on the Australian Securities Exchange as MedAdvisor Limited. Meanwhile, MedAdvisor Solutions, its business in the United States, will continue to operate under a royalty-free licence agreement with Jonas.

THE LARGER CONTEXT

The sale of MedAdvisor's ANZ business is a result of a company-wide strategic review, which started in November last year and was initiated after finding the business poorly valued in the market.

It first received Constellation's intent to purchase the undervalued company in May at a price that MedAdvisor board directors found "materially higher than what is implied in the current share price."

MedAdvisor supplies the digital pharmacy platform underpinning the expanded scope of community pharmacy practice in Queensland.

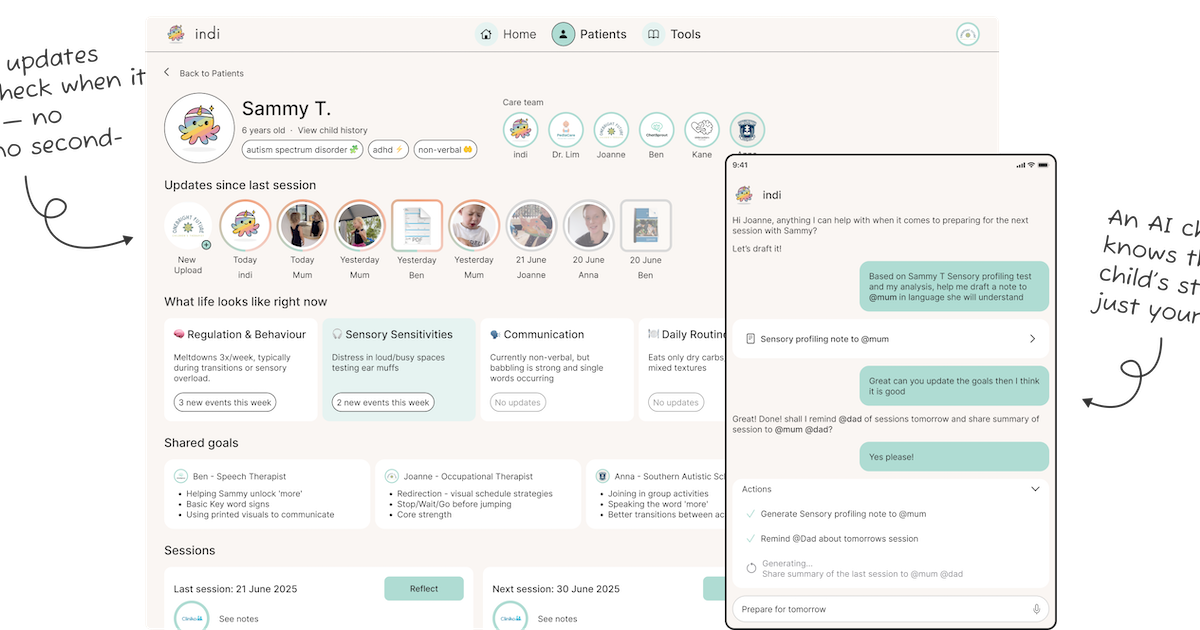

Last year, the medical software company explored and implemented new features to its platform offerings, including telehealth functionality on its mobile patient application and conversational AI on its new Medication Advisor platform.

Following its sale, MedAdvisor is now "sharpening" its focus on its US business. "While near-term market headwinds persist, we remain confident in the strength of our platform, the depth of our client relationships, and the strategic investments positioning us for long-term growth," CEO Ratliff shared.

After costs and debt repayment, the company will consider how the remaining proceeds from the sale will be deployed to support the operations of its US business.

"We continue to evaluate options for the US business and look forward to updating the market in due course. These activities continue to target maximising value for shareholders," added Ratliff.